What’s Your Category Game?

How to set a new game to win in tech

This is Part 1 in a blog series on Category Management

Every ambitious tech founder wants to create a new category. Yet, every repeat founder knows how hard it is to do so.

The market you choose to enter and the category you play in is one of the most existential questions for a tech company.

Even then, many startups fail having never understood the dynamics of the category they are part of - willingly or not.

In B2B, how is your market different from your software category? Why should you care about the category? Why isn’t having loyal customers or a cool product enough? And, if you need to play in a category, how do you set your game that helps you win?

These are the questions I explore in this post and the next.

Category versus Market

Often, founders conflate the market with the category. All tech products need to solve a problem to be viable. And in business, all products need to find buyers.

Category is the problem space you apply your product to, and the market is where you find the buyers.

You can categorize a problem space based on many attributes: some external (use cases, Job-To-Be-Done, purchase criteria, etc.) and some internal (product capabilities, underlying tech etc.).

Let us take an example. Suppose you have an AI-based data annotation product. The problem space or the category is “how to annotate data for ML purposes at scale”. This can be further categorized in many ways - by users (marketers, agencies), buyers (VP Marketing), jobs (creating blogs, writing web copy) and so on. Not only do you have direct competitors, you may have custom-built solutions, open source alternatives and substitutes that compete in the problem space.

The market is simply where the buyers are for your category. Market can be segmented by geography, size, vertical and so forth.

Consider the category-market as a combination of what problem your product solves and where are the buyers who are looking to solve it.

Tech founders often view the category-market combination as an amorphous landscape. They may choose to select a corner based on chance or opportunity. This is dangerous because how you segment your category and how you select your early market determines your short-term success in finding product market fit and long term success in reaching scale.

Category Dynamic - An Underrated PMF Factor

Most founders focus on building a useful product for early customers. This is as it should be. However, the category is the water you swim in.

The category dynamic can either help or hinder you to find the right customers early on, and to scale with the right customer segment later on. This helps you find the right entry point into a market, and sets the right trajectory for growth.

Category is the most underrated factor in finding product market fit. It is not enough to understand the category, you need to know how to play the category game in a way that improves your odds of success.

Why Category Games Matter

Category leaders capture 75% of the profits.

This is true across various businesses. Categories are created and destroyed through new tech. Today, Chat GPT and LLMs are wreaking havoc by reconfiguring existing categories - from software infrastructure to business apps to consumer solutions.

New business models can also create and destroy categories.

SaaS subscription model powered Salesforce, and obsoleted most on-premise software, whereas CPC (cost per click) in advertising changed the fate of Google.

So, winning a category game is high stakes.

Category wars are funded, won and lost years in advance of mass adoption.

By the time Microsoft Azure and Google Cloud entered the cloud computing category, Amazon AWS had more than five years head start.

This offers a paradox to early stage tech companies:

Why do we need to play a new game when the majority of the market may not care about it?

Many founders find the category dynamic confusing because their ground reality appears to be different. Their early adopter customers are hungry to solve a problem, and usually don’t care about category definitions. It is the late majority & laggard customers who adopt a product based on category leadership - but only after a category is proven, and the leader evident.

There is a survivor bias to category leadership.

Only those innovative companies who survive in creating new categories get to be category leaders. Therefore, it may appear that new categories are “created” in hindsight. They are usually anointed by industry and financial analysts for the buyers who don’t want to get “fired for choosing IBM.”

This paradox makes early stage founders complacent about their category. They find product market fit and start building for the growth stage, but by then the die may be cast for their category game. For this reason, your category game may set the upper limit to your growth.

Choice: To Create or Join a Category

You can either create a category or join one. This is a consequential choice - so you need to consider it carefully.

Creating a new category requires a radical rethinking of your business. We consider Uber, AirBnB, Tesla, Apple as creators of new categories for a good reason. They offer more than innovative products. Each of them built a new business model, a new ecosystem of partners, and a new go-to-market around their tech.

So, category creation is a different craft than simply finding the product-market fit for a novel offering among an existing set of competitors.

There are lessons to be learned from category creation to compete better in an established category. Majority of tech companies join an existing category. So that is what I focus on in this post. However, I will cover the topic of creating a new category briefly in the appendix of the next post.

Competing in an Existing Category with a New Game

To join and compete in an existing category, you need to set up and play a new game to win against incumbents. The new game is about advocating a point of view (POV) to solve a hard set of problems, trade offs and compromises that have not been addressed in the category by other companies to date. Your category POV has to be a non-consensus viewpoint else it would be common practice among customers already. For this POV to have teeth, the users and buyers must change the criteria by which they select and purchase products respectively.

Notice that this new category game has to be rooted in your product differentiation but it is not about the product.

It is about changing the category scorecard in your favor so that some customers - the early adopters - who are aligned to these new, changed criteria, choose your product to solve hitherto hard problems.

Here is how you do this.

Understand the Current Games

Any good problem space already has various solutions and multiple vendors working to deliver these. Each might have a slightly different take on the problem space - and would optimize for different trade-offs to solve the category problems. Yet, there is often conventional wisdom in your category.

Start with these two questions.

What is the consensus POV that majority players in the market agree on?

And what’s the projected future based on it?

Example: Generative AI

Gen AI technologies are a seismic shift that are upending virtually every software category. There are consensus views on how these will change industries, work practices and economies at scale, as described by analysts like McKinsey or summarized by LinkedIn. These are informative at macroeconomic level but of little consequence for tech startups.

In problem spaces (categories) like gen AI for healthcare payers, gen AI for shopping online, or gen AI for coding, or chat bots like Bard there are consensus POVs emerging from large incumbents. Dozens of startups in every category, such as AI content creation, are attacking the problems with similar insights.

In the sea of sameness, it is important to begin with how you are different from the very start.

How to Set a New Game

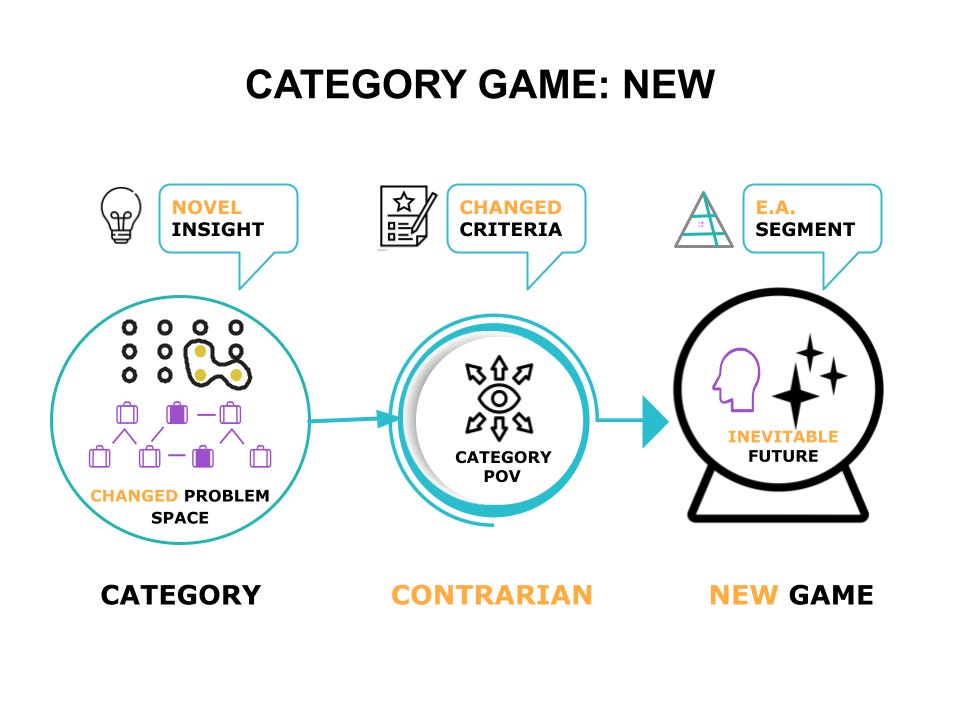

Here is the summary dynamic of a new game.

You begin with a novel insight into solving a category problem, tradeoff or constraint that has not been addressed by incumbents.

To realize this insight you offer a new way contrary to conventional wisdom. This contrarian POV now can be the basis of your market differentiation. Note that we are still not talking about product features per se.

For it to be effective, your POV must change or elevate the criteria for using or buying the category - contrary to consensus.

It is important to note that such a contrarian POV will not be accepted by most customers. In fact, usually it would be rejected by the vast majority of customers who are not willing to acknowledge or accept the importance of the novel insight - or your approach to solving it.

This sets up a challenge for the tech company.

They need to identify those early adopters who are desperate enough to solve the problem based on the novel insight and contrarian POV.

Ideally, you create a vision of a new but inevitable future that unfolds from your POV that appeals to early adopters.

Let us break each of these steps down with examples.

Find a Novel Insight into the Category

Each problem space is complex with many unsolved challenges. You should begin with understanding the major problems, trade offs or compromises in your category. What are your views on the root causes of the category problems? How well can you assess these causes? Do you understand the different customer & market segments affected by these?

The best start to a new game is to begin with a novel insight (tech or business) to address one of the specific category challenges.

A novel insight is born from your fresh take on a category problem - and it is usually simple.

Three examples:

Salesforce started with the insight that on-premise sales software is harder to install, maintain and upgrade. And that was the beginning of the SaaS (software-as-a-service) app revolution.

Amazon AWS started with the novel insight that developers don’t want to manage complexity and cost of compute infrastructure. And so was born cloud computing that offered developers low cost compute resources whenever they wanted at pay-as-you-go pricing.

Stripe started with the insight that developers find it hard to implement payments into the commercial apps or websites. This resulted in an extremely easy to use payment API-as-a-product that hid all underlying complexity of implementing and scaling payments on a website.

In many B2B software categories, an insight is as straightforward as: a better user experience, coherent design, simpler integration, higher service levels, faster time to delivery, cheaper ways to collaborate, etc.

Usually, a novel insight should suggest a new way to solve the problem. Else it is banal.

Generate a Contrarian POV

Anchored in your insight, you can construct a POV that highlights the biggest differences in your way.

Here are three questions to find the differences:

How is your approach different from others to solving the category problem?

How is your tech offering different?

A common mistake is to think of a product in technical terms. Of course, it may well have a hard core tech like a new AI model, a new schema or a new patent. But more often, it can also be a method, a framework and an economic model or combination of these. Therefore, I use the term offering - not simply product. There is a big difference between the two. An offering incorporates more than your tech. Brian Arthur calls this a “phenomenon” that your technology captures. Peter Thiel calls this “a secret”. A perfect example of this is Google ad tech offering - it uses both search engine algorithms and PPC pay-per-click ad model.

How is the customer outcome different for the category problem? Focus on the biggest difference on the value, from customer perspective

Your cogent answers to these questions will become your contrarian POV. This sets up your differentiation at the highest level of the category.

Contrarian POV examples:

Salesforce: IT does not need to deploy sales software on-premise because the Salesforce app runs in the cloud.

AWS: Developers do not need IT to buy and manage expensive infrastructure because Amazon AWS offers flexible compute-as-you-go resources.

Stripe: Developers do not need to build or manage complex payment APIs because Stripe has the easiest way to deploy full payment API without any management headache.

Canva: People do not need expensive and complex design tools (Adobe Illustrator, Photoshop) to create and collaborate on graphic projects because Canva offers lower pricing and better collaboration for designers and non-designers alike.

Determine How Your POV Changes Category Criteria

Having an intellectual POV is not enough.

Your POV should affect how your users select and use your product and how your buyers evaluate and purchase your product over all other competitors in the market.

In short, your contrarian POV must change the criteria or the scorecard in the category.

Identify Your New Game for USERS

From your Contrarian POV, you need to identify the changes to the users’ jobs to be done (JTBD) - and how would you position these changes to them.

These are the questions to consider along two axes:

JTBD Progress: Better or Worse?

How does your tech offering change users’ JTBD? Do their jobs improve by using your product or do they need to overcome more obstacles and main? How would users use your product in either case?

JTBD Economics: Cheaper or Expensive?

How does your tech offering change users’ economics? Is it cheaper or more expensive to get the job done? How would users select you in either case?

This can be summarized in competitive terms as your new game for category usage.

DOMINATE by redefining category usage

Amazon AWS was adopted by developers who saw the value of both cheaper and better infrastructure management.

DISRUPT by challenging category usage

Remember it is possible to have a setback in user JTBD in B2B categories if the economic trade off is clear. A business owner may voluntarily use an inferior or narrower product if it is cheaper. Or, a senior buyer may mandate use of cheaper products among users even if their JTBD gets harder. A lot of regulatory, security and compliance products fit here.

DIFFERENTIATE by niche-ing category usage

Slack was adopted by engineering teams despite the fact that they had access to cheaper and often free collaboration software like email and chat.

This new game should be identified and positioned in user growth strategies.

Identify Your New Game for BUYERS

Similarly, you need to identify the changes to the buyers’ business value stream based on your contrarian POV - and how to position these changes to them.

These are the questions to consider along two axes:

Business Value Stream: Better or Worse?

How does your tech offering change buyers’ value stream? Does their business stream improve or get worse by using your product? How would buyers evaluate your product in either case?

Business Value Stream: Cheaper or Expensive?

How does your tech offering change buyer economics? Is your offering cheaper or more expensive versus alternatives? How would buyers purchase you in either case?

This can be summarized in competitive terms as your new game for category purchase.

DOMINATE by redefining category purchase

Canva has disrupted the graphic design industry by making design more accessible to everyone with its limited features but easy creating and sharing capabilities at lower pricing. This has forced traditional graphic design software companies to rethink their complex products and high pricing.

DISRUPT by challenging category purchase

Amazon AWS was not adopted by IT buyers initially. Although AWS dominated the developers who loved the cloud compute capabilities, there were a lot of buyer shortcomings in the area of security, customization, control and budgeting. AWS challenged the purchase criteria starting with a small group of early adopter IT leaders, and slowly moved to dominating the category, once the mainstream buyers had accepted the buying criteria of cloud computing.

DIFFERENTIATE by niche-ing category purchase

Once Slack was adopted by users (engineering teams), the buyers were able to accept that a premium price had to be paid for an integrated chat-email product beyond what was available through incumbent at that time. Only after five years did the Microsoft Team product catch up to overtake the differentiated niche of Slack.

This new game should be identified and positioned in buyer growth strategies.

Paint an Inevitable Future from Your New Game

Once you define a new game, it is helpful to paint a future that could play out if your contrarian point of view were adopted by the category. While I am calling this an inevitable future, this may not play out exactly as the tech company expects.

This “inevitable” future can become a co-evolving vision between a company’s roadmap and its market adoption.

How well this inevitable future co-evolves in the market depends on how you segment, target and position your new game. I cover that in Part 2 of this series.

This is Part 1 in a blog series on Category Management.

Part 2: Playing a New Category Game

References

The One Who Defines the Category Wins the Category | by David Sacks | Craft Ventures | Medium

Economic Potential of Gen AI - McKinsey

Peter Theil’s seminal book: Zero to One

My short blog post on Zero to One: A Radical Manifesto for Tech Pioneers

The Nature of Technology W. Brian Arthur