Why Bridging Across Growth Pathways Is Hard

And How To Shift Between Top Down & Bottom Up GTM Strategies

This is Part 11 in a blog series on Customer Relationship Marketing.

In this series, we have now looked at the patterns of how to audit and build customer relationships for three separate growth pathways: product led, account led and channel led. Based on these patterns, we can now look at what it takes to shift from one pathway to another.

Bridging Across Growth Pathways Is Hard

Most startups begin with a single growth pathway, and scale it before adding in other go-to-market motions. If the founders are product techies, they are likely to begin with finding early users and driving product adoption among them and if they are sales or business leaders, they start by selling into buyers at key accounts they have prior relationships with. This focused bottoms-up or top-down approach has worked for business customers in the past but less so today. At some point of company growth, typically at $20-30MM ARR, the company hits a wall.

They run into the issue that there are different customer types in business marketing. There are at least four subtypes for software companies: business buyer/user and tech buyer/user.

And depending upon their product offering, they need to target multiple customer types to achieve growth. For business applications or services, a company needs to target both business buyers and users and for tech & infrastructure products, they need to convince both tech users (developers, admins) and tech buyers (CIOs) as well. In the case of business platforms and marketplace offerings, the customer go-to-market motions can be even more complex. [Details here].

At this point, the tech company needs to shift to or more likely add a new pathway to their current go-to-market motion. If they have been user focused, they need to shift to buyer focused value propositions in key accounts; and if they have been buyer focused, they need to shift to user focused adoption in a market segment. And if they have created channel partnerships, they need to adjust these to accommodate this shift. Such a shift in customer subtypes is more than commercial effort: it requires changes to tech product offering to serve different customer needs. As the company moves to multiple growth pathways, it faces the challenge of timing and orchestration across these pathways.

Let us look deeper into the two shifts that are most common for growth.

From Product to Account Led Growth, Shift to Buyer Value

The customer relationships for a product-led company are built for scale, starting with reach among a broad user base and eventually building relationship power with its few, product champions. The focus is on assisting the users in progressing the job to be done - with the help of the product. However, as a large number of users become successful at doing new or different jobs within an account, business processes and team structures need to change. The more successful the product is in use, and the more it spreads among users within an account, the more disruptive it is to the business at large. Soon, the IT team weighs in on product security, regulatory teams on compliance and finance teams on commercial teams. In extreme cases, some jobs may be consolidated or eliminated because of product use. Invariably, the business buyer is called to justify the economic value proposition and defend the organization changes triggered by product adoption among the users.

In a nutshell, even if the company has achieved product-user fit within a segment of business or tech users, they shall need to address the needs of their enterprise business or tech buyers in order to grow.

Therefore, as the product led company moves to account led growth, it has to add a new set of relationships between the buyer and its sales, marketing and success teams across the customer lifecycle.

The buyer can be a single champion or a large buying unit. Practically, this means identifying the right set of buyer personas and insights, delivering a compelling business value proposition to each member of the buying unit, and to convince the champion of the changes needed to processes & org for adoption of product within the account.

For business buyers, the value proposition has to center on improving the business value chain or operations that buyer is responsible for; whereas for tech buyers, the value proposition needs to anchor on how product usage improves software value stream or operations [how company builds, runs and operates its software and IT infrastructure].

Bottom line, the commercial value of the product has to be reaffirmed with the buyer along with the need to make org changes triggered by the technology. All this is very different from serving the user's needs.

Practically, this shift means adding and building new sales and support teams who can build relationships with buyers, and then training them to deliver the value proposition. For channels, this shift means adding account-led pathways [sell thru/sell to/sell with] to ensure the channel partners can also deliver the value proposition to the buyers. [Details].

Finally, the tech offering itself needs to be modified for the buyer: features and terms that buyers or tech guardians need are not the same as those for the user. Examples include reporting of value metrics from product usage, master service agreements, buyer focused pricing, security roadmaps, and compliance to regulatory needs.

Two examples of product categories that have navigated this shift are enterprise collaboration tools [like Zoom, Asana, Miro, Google Workplace] and design/developer tools [Figma, Github, Atlassian]. Such companies began with a product led approach targeting users who adopted the tools organically to get a job done within their team or business unit. Over time, these tech companies added account-led growth to their go-to-market motion: they invested in top down sales, account focused customer support and channel partnerships that served the buyers, not the users. Product superiority and user adoption was not enough for their long term growth.

Often product led startups are surprised by the difficulty of dislodging incumbent or even inferior products in an account because they underestimate the equity of long term buyer relationships, importance of economic value propositions and org change management needed for account led growth.

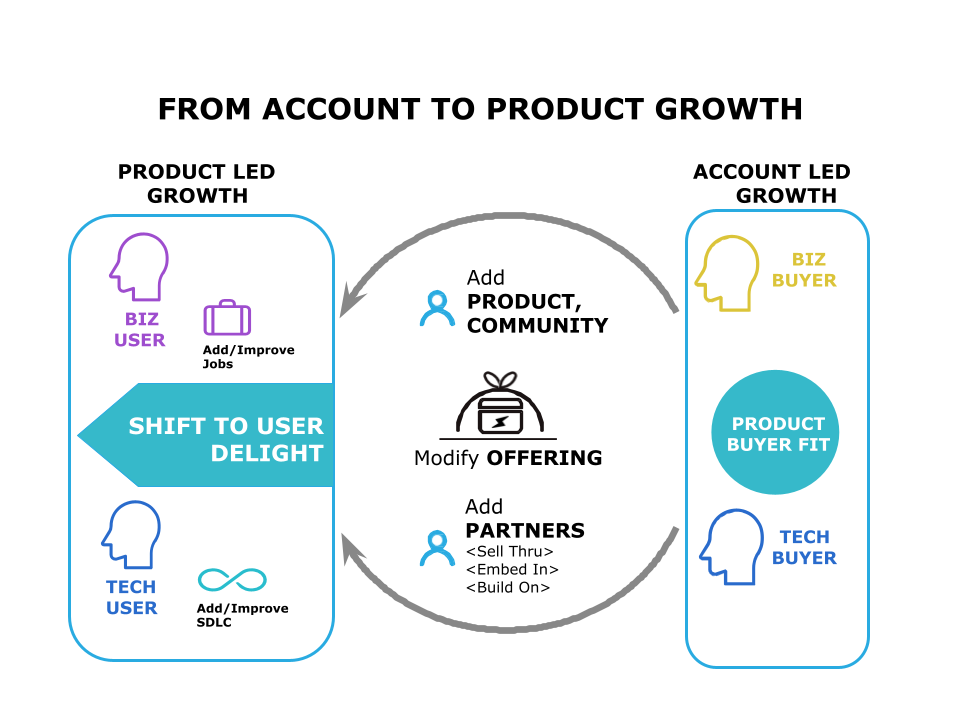

From Account to Product Led Growth, Shift to User Delight

Conversely, the customer relationship equity of an account-led company is based on access to powerful buyers with whom the customer-facing teams have deep relationships. The focus is on helping these buyers become champions of the business value delivered through the product. Over time, these buyers become agents for the change needed in the organization for the product to be adopted by users. In this top down approach to user adoption, business buyers or IT teams mandate product usage. Example: employees usually don’t get to choose collaboration software; a company standardizes on Microsoft Teams software for better or worse. Same is true for Salesforce or Netsuite and other business process applications that are selected by executive buyers. This can result in orderly org changes and process standardization which has its benefits, especially in regulated industries. However, such an approach is a combination of user “carrots” - such as rewarding user ambassadors - and user “sticks” - mandating the product use over alternatives through management edict, IT rules or regulatory demands. Often, the result is that while the buyer may achieve business benefits, the user satisfaction or progress with their job to be done remains low, which can result in users abandoning the product and customers churning over time.

In a nutshell, even if the company has achieved product-buyer fit within a set of accounts, they shall need to address the needs of their enterprise users in order to grow.

So, for an account-led tech company to move to product-led growth, it has to build a new set of relationships with the users within an account. Practically, this means the company has to identify the key user personas, make product changes to improve user engagement, and invest in growth marketing to drive user acquisition and retention within an account.

This in turn means the front line user-facing functions need to be strengthened. Product managers, product and growth marketers and product support teams need to get closer to the users. Bottom line, the product-user fit has drifted and needs to be reestablished by mapping better to the user’s job to be done.

From channels perspective, the company needs to expand its user reach by product-led channel strategy, such as sell through a marketplace, embed in a partner’s product network or build upon a platform that has the user audience. [Details]

Finally, the tech offering itself needs to be modified for user adoption: features that sell the buyers are not the same ones that drive user adoption. In case of business users, these changes mean discovering key user personas, identifying jobs to be done, and testing for product-user fit. For tech users like developers, data engineers and sys admins, the product needs to support their software development cycle [SDLC] or their operational processes. Also, the product pricing and terms of use may need to be changed for bottom-up trial and adoption.

All this is very different from serving the buyer's needs. Strong account relationships with the buyers and past economic value propositions may not be enough. Often, account-led companies are surprised at the loss of their top accounts, even those with strong buyer relationships and sweet renewal terms, when the users within the account abandon their products to competitive products that are easier to try and adopt to get their jobs done.

A vast majority of first generation SaaS products fit in this category, such as business process oriented sales, finance and HR apps from the 2000s. These old SaaS products were sold and renewed successfully for many years with account-led growth strategies. They are now getting replaced “bottom-up'' by better products following product-led user adoption into their accounts.

Challenges: Timing, Orchestration & Culture

Most B2B companies have come to recognize the need for both top-down and bottom-up GTMs in their growth plans. Even so, they have to decide when to layer on a second pathway. In SaaS companies, the product led growth is the rage today since its long-term capital needs are low, and economics are compelling. Once a tech company scales to $20-30MM with a bottom up approach, it then needs to add top-down sales motion to reach the next growth level. On the other hand, if the company has started with large accounts, especially in regulated industries with higher barriers to entry, they still need to add a bottom-up approach to product adoption within these large accounts to drive usage - and their long term success.

When and how to add channels is another critical timing question.

If the product is easy to use, product led channels may help deliver it in hands of new users; and if the tech offering is complex, account led channels may add services and missing capabilities to increase reach among buyers. These are the considerations but the decisions vary substantially based on product-user and product-buyer fit.

Within a company, adding new growth pathways means significant challenges in orchestrating across the teams and processes that are assigned to each pathway. Product centered teams drive user adoption, while sales & customer success teams drive buyer activation at accounts. While these two teams and processes can run in parallel, they need to be orchestrated together at key moments, such as opening a new channel partner, onboarding a major account, and opening a new user segment.

Beyond key moments, there is significant cross pollination of skills and resources across these GTMs.

For example, sales teams need to have embedded product experts and product teams often have business value engineering capabilities. The best in class companies recognize and ensure there is alignment to orchestrate these key dependencies across top-down and bottom-up initiatives.

Finally, these two pathways represent different cultures within a company.

Top down, sales driven culture is different from the engineering culture of building products. Sales culture relishes and rewards the art of the deal and the large size of the prize. If unchecked, sales can drive the product roadmap based on what will sell (cool features that demo well) or what the buyer or tech guardians need (reporting, security, etc.). While this may be legitimate for account growth, the focus may shift away from delighting the users of the product. Conversely, product culture prides on creating cool stuff that delights and engages users, and drives user growth. Such culture discounts the craft of selling business value to buyers - and if unchecked, can turn envious of sales landing and celebrating large deals with new product commitments. Though some of these product commitments may not serve the user, they may be necessary to grow accounts and revenue.

How the company leadership recognizes and blends these cultures is a critical part of building this bridge between different growth pathways.

Key Takeaways

Most companies start with a single growth pathway: product led or account led. At about $20-$30MM they hit a wall since B2B growth depends, ultimately, on serving both the users and buyers, often across business and tech functions

At this point, companies need to add or shift across a different pathway, which can be hard

If the company started with product-led growth and grew through user adoption (product-user fit), they now need to shift to account-led growth.

They need to add sales, customer success and account based partner channels to get closer to buyers. They may need to modify their tech offerings to meet buyer needs, rather than for users only. Overall, the shift is towards delivering business value to buyers

If the company started with account-led growth and grew through selling to buyer needs (product-buyer fit), they now need to shift to product-led growth

They need to add product managers, community and growth managers to drive user adoption. They may need to modify their tech offerings to meet user needs. Overall, this shift is toward delighting the users with the product.

Shifting between top-down and bottom-up GTM approaches also poses challenges of timing, orchestration and culture. Beyond adding new customer relationship skills and product changes, these challenges need to be managed by company leadership

References

On Combining Bottom-up Adoption AND Enterprise Sales | Andreessen Horowitz

Adding Top Down Sales: The “$20M to $500M” Question | Future

This is Part 11 in a blog series on Customer Relationship Marketing.

Part 1: Who is the Customer in Business Marketing?

Part 2: Key Customer Relationships for Tech Offerings

Part 3: Orchestrating Three Pathways into Business Customers

Part 4: The Hidden Purpose of Customer Relationships

Part 5: Pursuing Business Growth with APIs

Part 6: What is Customer Relationship Equity?

Part 7: Towards A Customer Relationship Model

Part 8: A Pattern for Account Led Growth Relationships

Part 9: A Pattern for Product Led Growth Relationships

Part 10: Patterns for Channel Led Growth Relationships